Debt Transparency

Pine Tree ISD believes in providing our taxpayers with clear and relevant financial information in a format that is transparent, easily accessible, and understandable.

PINE TREE ISD DEBT OBLIGATIONS

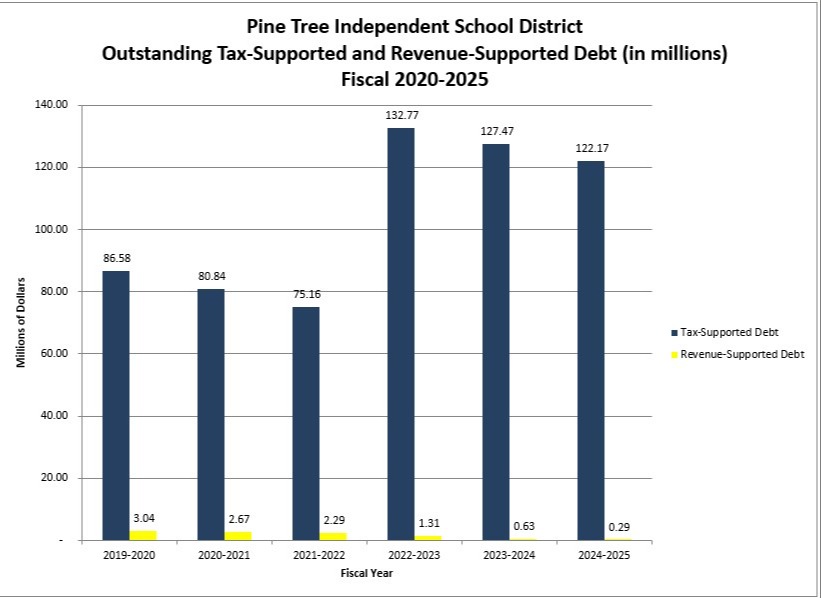

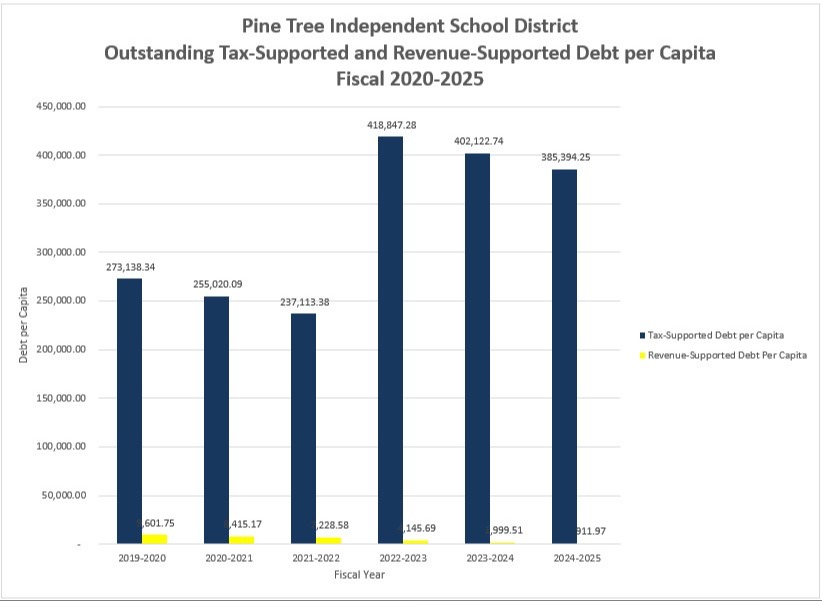

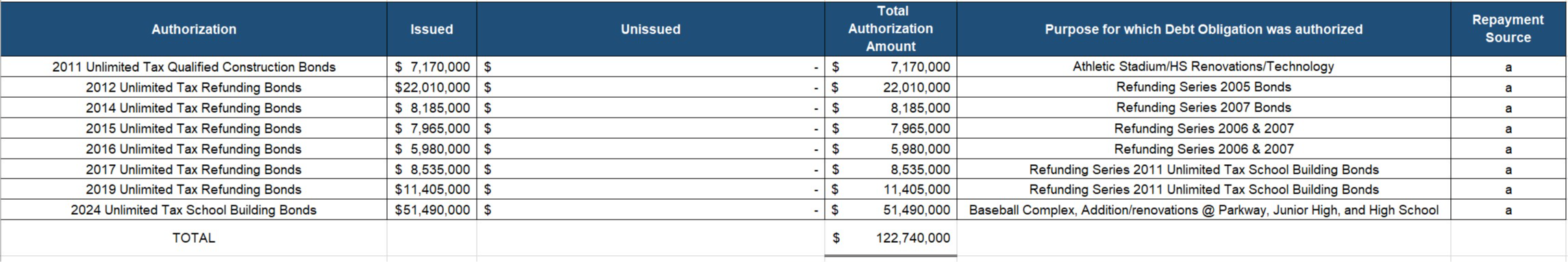

School districts and other government entities issue bonds to finance major expenses such as buildings, building renovations, equipment improvements, and more. A bond election approved by the district's voters allows the district to issue bonds as needed to supply the needed cash to undertake these projects and improvements.

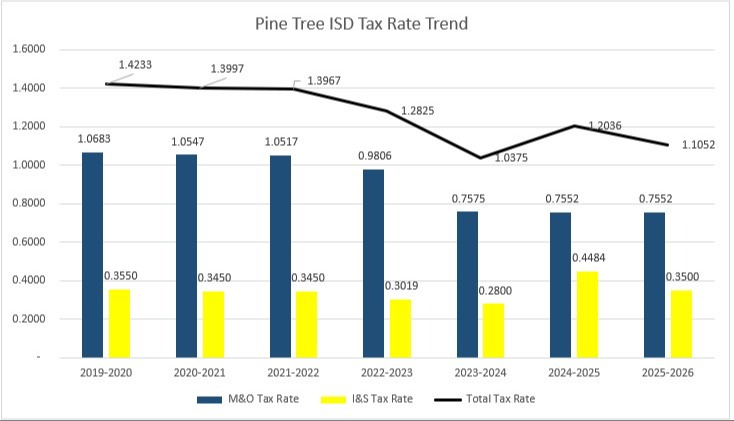

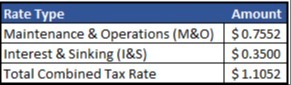

Bonds are issued similarly to a homeowner's mortgage in order to finance the purchase over time. The Interest & Sinking (I&S) tax rate is set each year to generate tax revenue sufficient to repay debt payments for the year. The second part of the districts tax rate is Maintenance & Operations (M&O) tax rate is used to fund the day to day operations of the district.

2024-2025 TAX RATE

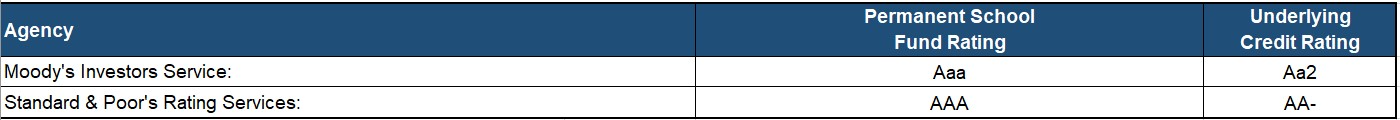

CURRENT CREDIT RATINGS

HISTORICAL BOND ELECTION INFORMATION

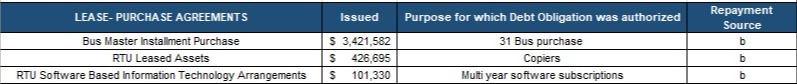

TOTAL LEASE-PURCHASE OBLIGATIONS